Part 2 of Kelvin Stott’s great work on pharma declining R&D ROI. Why aren’t we finding and drugging new therapeutic targets more efficiently?

By Kelvin Stott, Director, R&D Portfolio Management, Basel, Switzerland

In Part 1 of this blog, I introduced a simple robust method to calculate Pharma’s Internal Rate of Return (IRR) in R&D, based only on the industry’s actual historic P&L performance. Further, I showed that Pharma’s IRR has followed a rapid and steady linear decline over 20 years, which is consistent with recent estimates from BCG and Deloitte, and can be fully explained by the Law of Diminishing Returns as a natural and unavoidable consequence of prioritizing a limited set of investment opportunities while each new drug raises the bar for the next. Finally, I showed that a simple extrapolation of this robust linear trend means that Pharma’s IRR will hit 0% by 2020, which implies that the industry is now on the brink of terminal decline as it enters a vicious cycle of negative growth with diminishing sales and investment into R&D.

Here in Part 2, I explore the mathematical relationship between R&D productivity, IRR and past and future P&L performance in more detail. In particular, I show how the linear decline in IRR actually corresponds to an exponential decline in nominal Return on Investment (ROI) as a more direct measure of R&D productivity, which then leads directly to terminal decline in future P&L performance. I then use this model to run some what-if scenarios, to explore how much we will need to improve nominal R&D productivity/ROI in order to maintain positive P&L growth. The results show that we need a major breakthrough right now, in 2018, and even then we will face a period of significant contraction before any recovery, while anything less would be too little, too late to save the industry from terminal decline.

Finally, I identify the single limiting factor that is ultimately responsible for driving the decline in R&D productivity by the Law of Diminishing Returns, and I explain why many of Pharma’s past and current strategies (continuous improvement, new discovery technologies, in-licensing, precision medicine, big data and AI, etc.) have all failed and will continue failing to address the underlying issue. Moreover, I propose an alternative strategy that might just solve the problem, but while I have my own specific ideas in this area (not shared here, sorry), I hope to stimulate more critical strategic thinking, self-reflection and open debate in order to refocus the industry’s attention on developing alternative solutions to tackle the underlying issue before it is too late.

Nominal ROI as a direct measure of R&D productivity

In Part 1, I showed that Pharma’s Internal Rate of Return in any given year x can be calculated by the following formula, based only on the industry’s actual historic P&L performance:

IRR(x) = [(EBIT(x+c) + R&D(x+c)) / R&D(x)]^(1/c) – 1

Where c is the industry average investment period of 13 years, from an initial R&D investment to the resulting commercial returns.

Moreover, I showed that Pharma’s historic IRR has followed a rapid and steady decline over 20 years, which fits the following linear equation almost perfectly (R^2 = 0.9916):

IRR(x) = -0.00912*(x-2020)

This means that Pharma’s IRR has been declining at a steady rate of about 0.9% per year and is projected to hit 0% by 2020. This robust downward trend has recently been confirmed by yet another data point from Deloitte, which reported that Pharma’s IRR fell to a new record low of just 3.2% in 2017.

The IRR defines an effective interest rate that provides a more complete and accurate measure of return on investment over time, but R&D productivity is best defined and more easily understood as a simple efficiency ratio. In particular, the nominal Return on Investment (ROI) in any year x measures the absolute nominal value of commercial returns vs original R&D investment over the average investment period c:

ROI(x) = (EBIT(x+c) + R&D(x+c)) / R&D(x)

As explained in Part 1, note that the ultimate commercial returns include not only EBIT, but also future R&D spending as an optional use of profits that result from the original R&D investment.

Now, by substituting this equation into the original formula for IRR above, we can see that IRR is directly related to the nominal ROI as follows:

IRR(x) = ROI(x)^(1/c) – 1

And conversely:

ROI(x) = [1 + IRR(x)]^c

Finally, by substituting the historic linear trend above into the IRR term of this equation, and the industry average investment period of 13 years into the c term, we get the following formula, which shows that nominal R&D productivity/ROI currently stands at about 1.2 (i.e., we get only 20% back on top of our original R&D investment after 13 years), is declining exponentially by about 10% per year, and will hit 1.0 (zero net return on investment) by 2020:

ROI(x) = [1 – 0.00912*(x-2020)]^13 ≈ 0.899^(x-2020)

This result is consistent with an earlier report by Scannell et al., which shows that Pharma R&D productivity (in terms of NMEs per $Bn R&D spend) has been declining exponentially by about 7.4% per year since 1950 (99% over 60 years). Note that the 2.6% difference in the annual rate of decline must be explained by a decline in the average commercial value per NME, most likely due to diminishing incremental benefit as each new drug raises the bar and reduces the scope for improvement by the next, as well as increasing competition from generics and me-too drugs.

The direct mathematical relationship between IRR, nominal R&D productivity/ROI, and both past and future P&L performance is illustrated in the following 3 charts. Note that the trends represented by red dotted lines in each chart are all fully consistent with each other according to the formulae above, and fit closely with the historic P&L data as well as recent IRR estimates from Deloitte.

Now we can see clearly, in real terms, just how fast R&D productivity has been declining.

Furthermore, we can now use these formulae to predict the impact of improving nominal R&D productivity/ROI on future P&L performance, either by continuous improvement or by making major technology breakthroughs, in order to determine just how much improvement is required to maintain positive P&L growth and avoid terminal decline.

Impact of continuous improvement in R&D productivity

The ultimate goal of continuous improvement is to improve overall R&D productivity over an extended period of time, either by increasing the number or commercial value of new approved drugs, or by decreasing the R&D investment required to develop each new drug, or possibly a combination of both. In any case, change is slow and efficiency is improved only gradually by small amounts each year over many years.

So by how much do we need to increase nominal R&D productivity/ROI each year in order to maintain positive P&L growth and avoid terminal decline? Is it 5%, 10%, 15% or even 20%? And by when do we need to start making these annual improvements? Has anyone even asked these questions before?

Before we use the formulae above to calculate the impact of continuous improvement on future P&L performance, consider that any improvements must be applied to the current baseline. In other words, we must counteract the current annual decline in R&D productivity before we can start increasing overall R&D productivity in absolute terms. On that basis, the expected impact of consistently improving nominal R&D productivity/ROI by 5%, 10%, 15% or 20% each year from 2018 is shown in the following charts:

What we can see is that improving R&D productivity by 5% or even 10% each year from 2018 would slow, but not reverse the current decline in nominal ROI and IRR. Moreover, it would make virtually no difference to the projected terminal decline in P&L performance. Even a 15% annual increase in R&D productivity would barely be enough to avoid terminal decline, and the industry’s sales and profits would still fall by almost 50%.

In fact, we would need to increase nominal R&D productivity/ROI by at least 20% each year to reverse the projected decline in P&L performance, and even then, the industry’s sales and profits would fall by about one third before they begin to pick up again in 2030. This is because it will take several years for any improvement in R&D productivity to translate into increased sales and profits due to the long investment period. In other words, the next 10 years of P&L performance are already largely determined by the past and current low levels of R&D productivity, and there is now very little we can do about this.

So by when do we need to start making these annual improvements? The charts below show the impact of improving nominal R&D productivity/ROI by 20% per year from 2018, 2020, 2022 or 2024:

In short, we need to start improving nominal R&D productivity/ROI by 20% per year right now, from 2018, because the longer we wait the less impact it will have to avoid terminal decline.

A 20% sustained annual increase in R&D productivity is a very high target indeed, which would require increasing the number or average commercial value of new approved drugs by 20% each year, or decreasing the R&D investment required to develop each new drug by 20% per year. So is it achievable? Could any, or even all of Pharma’s strategies for continuous improvement ever make this much impact? Consider that none of Pharma’s past efforts at continuous improvement has made any difference at all to the rapid and steady decline in R&D productivity over the last 60 years. In fact, the impact of Pharma’s past efforts is already included in the current declining baseline, so how reasonable is it to expect that any of Pharma’s current strategies for continuous improvement will increase R&D productivity by an additional 20% each year, on top of what we have been able to achieve in the past?

I will leave this question open for readers to reflect, meanwhile let us now consider the potential impact of a major breakthrough in R&D productivity.

Impact of a major breakthrough in R&D productivity

Unlike continuous improvement, which requires making incremental annual improvements in R&D productivity over many years, new technologies have the potential to make a significant impact on R&D productivity within a short timeframe, and possibly even within a single year. Now, we have seen many breakthrough technologies in drug discovery over the years, and not one of these has made any difference to the rapid and steady decline in R&D productivity, but still let us consider: What if we could improve R&D productivity now in 2018 by 100%, 200%, 300%, or even 400%? What would be the impact on projected P&L performance?

Before we run the calculations, we must consider that a major breakthrough may provide a one-time jump in R&D productivity from the current baseline, but R&D productivity would then continue to decline at the current rate of 10% per year because no improvement is sustainable in the long term due to the Law of Diminishing Returns. On that basis, the impact of increasing nominal R&D productivity/ROI by 100%, 200%, 300% or 400% is shown in the charts below:

Here we can see that a 100% increase (two-fold improvement) in R&D productivity would delay the tail end of terminal decline by only 5 years, while a 200% increase (three-fold improvement) would delay terminal decline by about 10 years, but would not avoid it, and the industry’s sales and profits would still decline from their peak in the next couple of years. Even a 400% increase (five-fold improvement) in R&D productivity would only delay terminal decline by 20 years, but at least the industry’s sales could reach a new higher peak after a short dip.

I will discuss below how we might be able to achieve such a breakthrough in R&D productivity, but assuming we could increase R&D productivity by 400%, by when would we need to achieve it? How much time do we have left to develop and implement such a breakthrough?

The following charts show the expected impact of increasing nominal R&D productivity/ROI by 400% in 2018, 2020, 2022, or in 2024:

In short, we need to start improving nominal R&D productivity/ROI by 20% per year right now, from 2018, because the longer we wait the less impact it will have to avoid terminal decline.

A 20% sustained annual increase in R&D productivity is a very high target indeed, which would require increasing the number or average commercial value of new approved drugs by 20% each year, or decreasing the R&D investment required to develop each new drug by 20% per year. So is it achievable? Could any, or even all of Pharma’s strategies for continuous improvement ever make this much impact? Consider that none of Pharma’s past efforts at continuous improvement has made any difference at all to the rapid and steady decline in R&D productivity over the last 60 years. In fact, the impact of Pharma’s past efforts is already included in the current declining baseline, so how reasonable is it to expect that any of Pharma’s current strategies for continuous improvement will increase R&D productivity by an additional 20% each year, on top of what we have been able to achieve in the past?

I will leave this question open for readers to reflect, meanwhile let us now consider the potential impact of a major breakthrough in R&D productivity.

Impact of a major breakthrough in R&D productivity

Unlike continuous improvement, which requires making incremental annual improvements in R&D productivity over many years, new technologies have the potential to make a significant impact on R&D productivity within a short timeframe, and possibly even within a single year. Now, we have seen many breakthrough technologies in drug discovery over the years, and not one of these has made any difference to the rapid and steady decline in R&D productivity, but still let us consider: What if we could improve R&D productivity now in 2018 by 100%, 200%, 300%, or even 400%? What would be the impact on projected P&L performance?

Before we run the calculations, we must consider that a major breakthrough may provide a one-time jump in R&D productivity from the current baseline, but R&D productivity would then continue to decline at the current rate of 10% per year because no improvement is sustainable in the long term due to the Law of Diminishing Returns. On that basis, the impact of increasing nominal R&D productivity/ROI by 100%, 200%, 300% or 400% is shown in the charts below:

Here we can see that a 100% increase (two-fold improvement) in R&D productivity would delay the tail end of terminal decline by only 5 years, while a 200% increase (three-fold improvement) would delay terminal decline by about 10 years, but would not avoid it, and the industry’s sales and profits would still decline from their peak in the next couple of years. Even a 400% increase (five-fold improvement) in R&D productivity would only delay terminal decline by 20 years, but at least the industry’s sales could reach a new higher peak after a short dip.

I will discuss below how we might be able to achieve such a breakthrough in R&D productivity, but assuming we could increase R&D productivity by 400%, by when would we need to achieve it? How much time do we have left to develop and implement such a breakthrough?

The following charts show the expected impact of increasing nominal R&D productivity/ROI by 400% in 2018, 2020, 2022, or in 2024:

Here again, the bottom line is that we need a major breakthrough right now, in 2018, because the longer we wait the less impact it will have to save the industry from terminal decline.

Now, in order to evaluate how we might achieve this, we need to take another look at the Law of Diminishing Returns to understand exactly what is driving this trend so that we can finally figure out how to address the underlying issue.

Another look at the Law of Diminishing Returns

In Part 1 of this blog, I showed that the linear decline in IRR can be fully explained by the Law of Diminishing Returns as a natural and unavoidable consequence of prioritizing a limited set of investment opportunities. In particular, I demonstrated that prioritizing a limited set of random investment opportunities by their IRR over time produces a perfect linear decline in IRR, which passes right through 0%, exactly as we have seen with Pharma’s R&D productivity. Moreover, the IRR plot of prioritized investment opportunities follows a perfect linear decline regardless of their initial distribution.

In fact, the only condition required to guarantee that a sequence of investments follows the Law of Diminishing Returns in this way, is that the total number and/or potential value of investment opportunities is ultimately limited. In essence, there must be some critical limiting factor, which is both exhaustible and in short supply.

So what could be the ultimate limiting factor in Pharma R&D? It is certainly not the number of potential new drugs itself, since the number of possible drug-like molecules has been estimated to exceed the number of atoms in the entire solar system.

And it is not the unmet clinical need or potential value of new drugs, since we spend more each year on healthcare for our growing and ageing population. Indeed, there appears to be no end to human suffering, and we will always get sick and die at least once in our lives, despite medical progress.

The real answer, as I explain below, is that we are rapidly running out of viable new drug targets that could possibly be addressed with existing approaches and technologies.

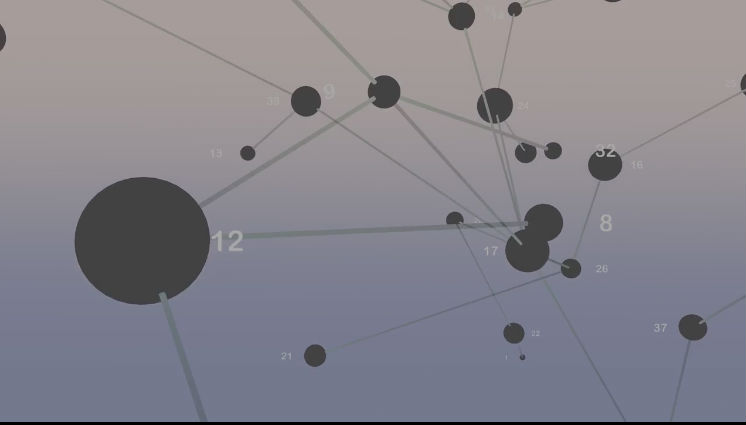

A diminishing pool of viable new drug targets

Ultimately, all drugs work by interacting with at least one specific molecule or “drug target” in the body. Furthermore, all such drug targets must satisfy all of the following criteria in order to provide a viable source of effective new drugs:

1. Clear correlation or relationship with human disease

2. Can be targeted with small molecules or large proteins

3. Not already exploited by existing approved drugs

4. Not already tested and failed due to mechanism of action

5. Commercially viable, linked to a clear unmet need

According to the Human Protein Atlas, there are 19,613 proteins encoded by the human genome. Of these, 14,545 (74%) have no known link or relationship with disease, which rules them out as potential new drug targets because they fail to meet criterion 1 above. Perhaps these proteins are non-essential, as any deficiencies can be compensated by other proteins or pathways; or perhaps they are essential, however any deficiencies are lethal before birth so they never have the chance to cause any disease. In any case, we have no reason to believe that targeting these proteins will do anything for any known human disease.

Now of the 5,068 proteins that have any link to disease, 3,131 (16% of all human proteins) are considered to be “undruggable”, either because they have no obvious pocket capable of binding small molecule drugs, or because they are intracellular and thus inaccessible to large proteins that cannot penetrate the cell membrane. We must rule out these proteins as potential new drug targets because we currently have no way to target them, so they fail to meet criterion 2 above.

This leaves only 1,937 potential drug targets (10% of all human proteins), but 672 of these have already been fully exploited as proven drug targets by current approved drugs. Once a new drug target is first identified and exploited by an original first-in-class drug, any “me-too” drugs that follow tend to provide little, if any incremental benefit or value to patients, and profit mostly by taking market share from the original drug. In essence, drug targets are an exhaustible resource rather like oil: once we have tapped its potential value, it’s gone; we can’t have our cake and eat it. Therefore, we must also rule out these proteins as potential new drug targets, simply because they are no longer new, and they fail to meet criterion 3 above.

So now we are left with only 1,265 potential new drug targets:

At first glance, it seems that we have more than twice as many potential new drug targets left to find and exploit as those we have already exploited, so we should not be overly concerned about running out any time soon. But what about the other two criteria, 4 and 5? How many of these potential drug targets have already been tested but failed to yield any drugs due to mechanism of action? How many have not yet been tested, but are still unlikely to yield any drugs? And how many will yield only drugs that are not commercially viable in any case?

Now this is where the numbers get a bit fuzzy because they are not widely reported (or at least I could not easily find them), but we can make some very rough estimates.

First, let’s say that about 50% of all drug targets we have ever fully tested produced at least one approved drug, while the other 50% failed to deliver any drug at all, due to fundamental reasons (e.g., safety) based on mechanism of action. Given that we now have approved drugs for 672 drug targets, this would imply that we have already fully tested a similar number of drug targets without ever producing any drug, so we can rule these out as potential new drug targets because they are not new, and fail to meet criterion 4 above. Furthermore, we can rule out another 50% (297) of the remaining 593 untested drug targets because they are unlikely to deliver new drugs for the same fundamental reasons.

Now we are left with only 296 potential drug targets, but how many of these will produce drugs that are commercially viable? It has been estimated that only about 25% of new approved drugs manage to fully recover their own R&D costs and make any commercial return. Many of those that fail commercially are me-too drugs that compete for the same drug target, but many are also novel first-in-class drugs that compete with other drugs acting by different mechanisms to target the same disease, or that target diseases with insufficient clinical need.

So let’s assume that 50% (148) of the remaining 296 potential drug targets are not commercially viable (i.e., do not meet criterion 5 above), and we are now left with only 148 potential new drug targets, compared with 672 that we have already exploited with existing approved drugs:

Again, this is just a rough estimate based on some crude assumptions, but still it is clear that we are rapidly running out of viable new drug targets that meet all 5 criteria above. We are literally scraping the barrel for the last remaining drug targets, and chances are we are already working on all these remaining targets in direct competition with each other. Now is it really any wonder that R&D productivity has been declining so rapidly by the Law of Diminishing Returns?

Limited potential impact of Pharma’s current strategies

Given that we are rapidly running out of viable new drug targets, it is easy to see why Pharma’s R&D productivity has been declining so rapidly by the Law of Diminishing Returns. Moreover, it is easy to see why none of Pharma’s past efforts has made any difference, and why none of its current strategies will make any difference, either: They do not address the underlying issue.

Almost all of Pharma’s past and current strategies are designed to improve R&D productivity in one or more of the following ways:

1. Increase the efficiency by which we identify viable new drug targets that meet all 5 key criteria listed earlier

2. Increase the efficiency by which we identify safe and effective new drugs against those targets identified in 1 above

3. Increase the quality and expected commercial value of those drugs identified in 2 above

For example, molecular biology, genomics, proteomics and bioinformatics have been developed to increase the efficiency of target discovery by improving our understanding of human biology and disease, while other technologies like rational drug design, cheminformatics, combinatorial chemistry and high throughput screening have been developed to increase the efficiency of drug discovery by exploring new chemical space. Meanwhile, open innovation and in-licensing have been developed to source new drugs and technologies more efficiently than internal innovation. Precision medicine with biomarkers and real-world evidence has been developed to increase the clinical benefit and commercial value of new drugs in specific patient populations. Now there is a big push with big data, machine learning and AI to make significant improvements in all these areas. And of course, continuous improvement has been Pharma’s favorite long-term strategy to improve overall efficiency.

Note that none of these strategies can increase the overall number of viable new drug targets that meet the 5 key criteria above. Instead, they are simply designed to exploit the remaining pool of viable new drug targets more efficiently, which ironically, will only accelerate its depletion.

These strategies have not worked, and will not work, because they do not address the underlying issue: We are rapidly running out of viable new drug targets that can be targeted by classic small molecule drugs or large therapeutic proteins.

So how can we address this problem to improve R&D productivity?

An alternative approach to improve R&D productivity

Ultimately, the only way we can break free from the Law of Diminishing Returns is to increase the number of viable new drug targets; and the only way we can do this is to remove or relax at least one of the 5 key criteria listed earlier.

At first, it seems that all these criteria are absolute critical requirements for any new drug target. For example, if there is no clear link with human disease, or if there is no clear unmet need, then there is no viable drug target. Furthermore, if we have already tested a drug target and it failed for safety reasons, or if we have already fully exploited it with existing approved drugs, then we cannot exploit it further. And finally, if we can’t hit a specific drug target with small molecules or large proteins, then we can’t develop an effective drug against that target.

Or can we? Are we really limited to using small molecules and large proteins as drugs to target specific proteins and treat diseases more generally?

Small molecules have the great benefit that they can penetrate cell membranes to reach potential drug targets within the cell, but on the other hand, they require a clear binding pocket within the target protein, otherwise they have the wrong size and shape to bind effectively and specifically to flat protein surfaces. Meanwhile, large therapeutic proteins such as antibodies can form much stronger, more specific interactions with such flat protein surfaces, but they are generally unable to penetrate cell membranes and get into the cell. Thus by limiting our potential drug repertoire to small molecules and large proteins, we are effectively limiting our pool of potential new drug targets to extracellular proteins, or intracellular proteins that have a clear binding pocket. At the moment, we have no means to target intracellular proteins that have no clear binding pocket, yet there are thousands of these “undruggable” proteins encoded by the human genome.

According to the Human Protein Atlas, 3,131 (about 16%) of all proteins encoded by the human genome are “undruggable” proteins that have a clear link with disease, but can’t be targeted with either small molecules or large proteins because they are intracellular and have no clear binding pocket. This compares with only 1,937 druggable targets, of which 672 have already been fully exploited with existing approved drugs, and perhaps only 148 remain viable as explained above. Therefore, we could potentially increase the total number of viable new drug targets by as much as 20 fold, if only we could find an effective way to target them. So how can we do this?

First, it is clear that small molecules do not have the size and shape required to bind effectively and specifically to large and flat protein surfaces. They are simply unable to compete with the tight and specific binding that occurs between different protein molecules within the cell, which is why we have never been able to develop an effective small molecule inhibitor of any known protein-protein interaction. Therefore, we are forced to use large molecules in order to compete effectively with these strong interactions, but this leaves us with the other problem: How to get such large molecules into cells in the first place?

If only we could find a reliable way to get large molecules into cells, then we could potentially target thousands of different proteins and protein-protein interactions that are currently beyond reach within the cell. So again, how to achieve this?

The cell membrane is notoriously difficult to penetrate, especially by large molecules, but nature has shown that it can be done. For example, several large macrocyclic antibiotics and bacterial toxin proteins are known to cross the cell membrane. So can we adapt these molecules to act as drugs once they get into the cell? Or better still, can we understand how they get into cells in the first place and apply these principles to design a whole new class of cell-penetrating therapeutic proteins that could be adapted to bind tightly and specifically to any target protein in the cell? I have my own specific ideas that I would like to pursue in this regard, but hopefully it is clear by now that getting large molecules into cells is perhaps the only way to address the real underlying issue of declining R&D productivity. This problem is too important to rely on just one idea, so we need to pursue as many potential solutions as possible, in order to reverse the decline in R&D productivity and save the industry from terminal decline, before it is too late.

In summary, Pharma R&D productivity is declining by the Law of Diminishing Returns because we are rapidly running out of viable new drug targets that can be intercepted by small molecules or large proteins. None of Pharma’s past or current strategies to improve R&D productivity has worked because they do not address the underlying issue, and the only way to solve this problem is to develop completely new modalities that can address currently “undruggable” targets within the cell.

It is still not too late, but time is running out very fast.

Disclaimer: The views expressed herein are my own personal opinions, and are not intended to represent those of my employer.

Original Source: LinkedIn